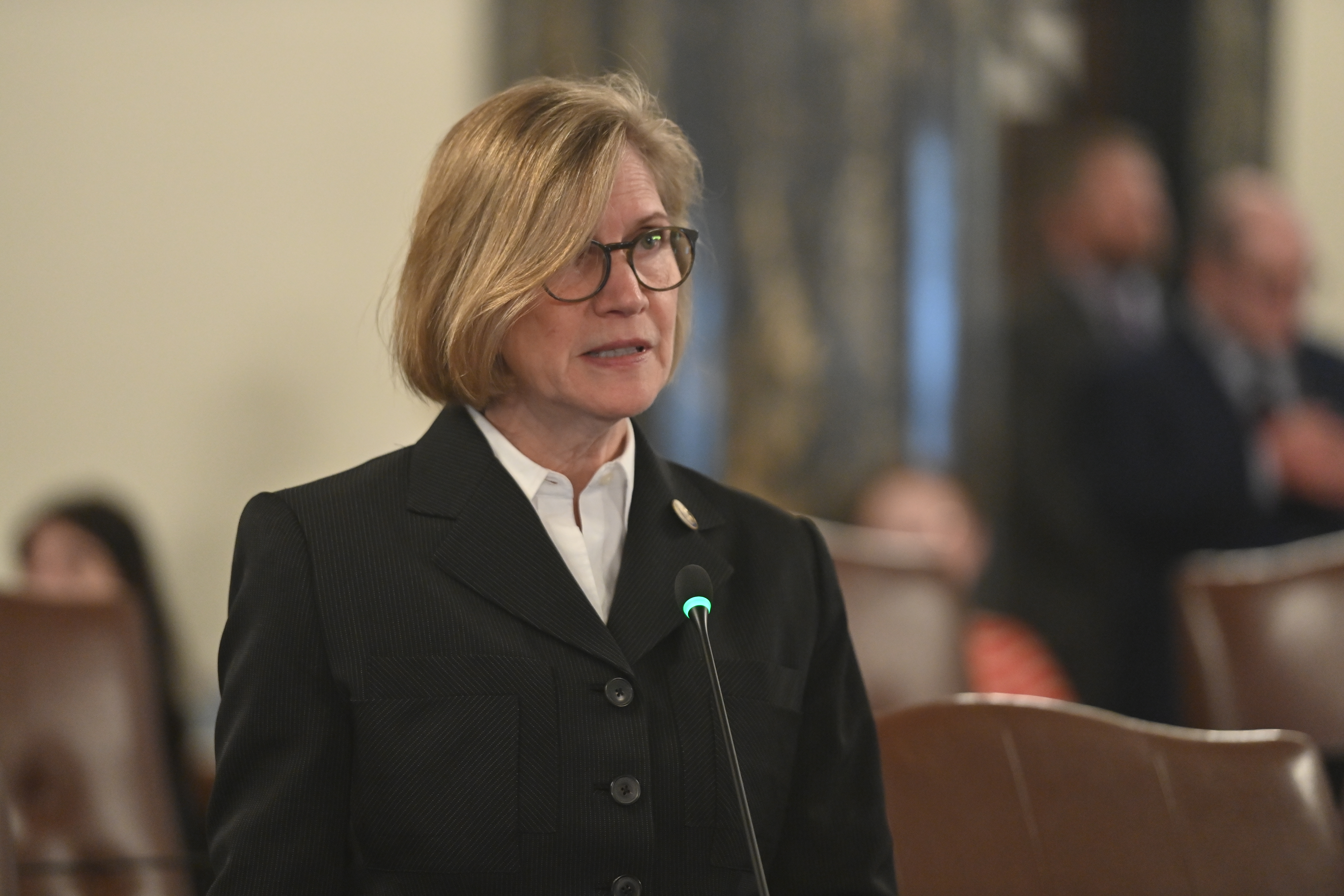

“Microchips and semiconductors are part of just about every piece of technology we use every day,” said Glowiak Hilton (D-Western Springs). “By providing these new incentives, we are creating jobs, keeping Illinois at the forefront of a growing industry and making our community a hub for manufacturing.”

House Bill 5005 brings new opportunities to the Manufacturing Illinois Chips for Real Opportunity Act, which offers incentives to companies that manufacture microchips and semiconductors in Illinois. MICRO allows businesses to receive tax credits on new and retained jobs, training costs, investments and construction jobs. Under the new law, manufacturers will be eligible for a tax credit when relocating from one site in Illinois to another. Additionally, individual taxpayers who focus on research and development and innovation in the space of semiconductor manufacturing, microchip manufacturing and the manufacturing of semiconductor or microchip component parts will be eligible for this program.

In 2022, the Illinois Manufacturers Association found the total economic impact of manufacturing in Illinois to be $580 billion to $611 billion annually.

“This law paves the way for Illinois to be a leader in innovation,” said Glowiak Hilton. “Expanding the MICRO Act allows our businesses to thrive and compete in the microchip market.”

House Bill 5005 was signed into law Wednesday and is effective immediately.