Glowiak Hilton highlights IDOT’s road conditions map for winter travel

- Category: Press Releases

OAKBROOK TERRACE – With snow flurries starting to appear in the forecast, State Senator Suzy Glowiak Hilton (D-Western Springs) is reminding commuters and residents with travel plans of the winter road conditions map on the Illinois Department of Transportation’s Getting Around Illinois website.

OAKBROOK TERRACE – With snow flurries starting to appear in the forecast, State Senator Suzy Glowiak Hilton (D-Western Springs) is reminding commuters and residents with travel plans of the winter road conditions map on the Illinois Department of Transportation’s Getting Around Illinois website.

“Winter weather can impact road conditions quickly, and getting reliable information to travelers is essential to prevent vehicles from sliding and crashing on the roadways,” Glowiak Hilton said. “I encourage residents and commuters to check the Getting Around Illinois website when snow and freezing temperatures are predicted in the forecast.”

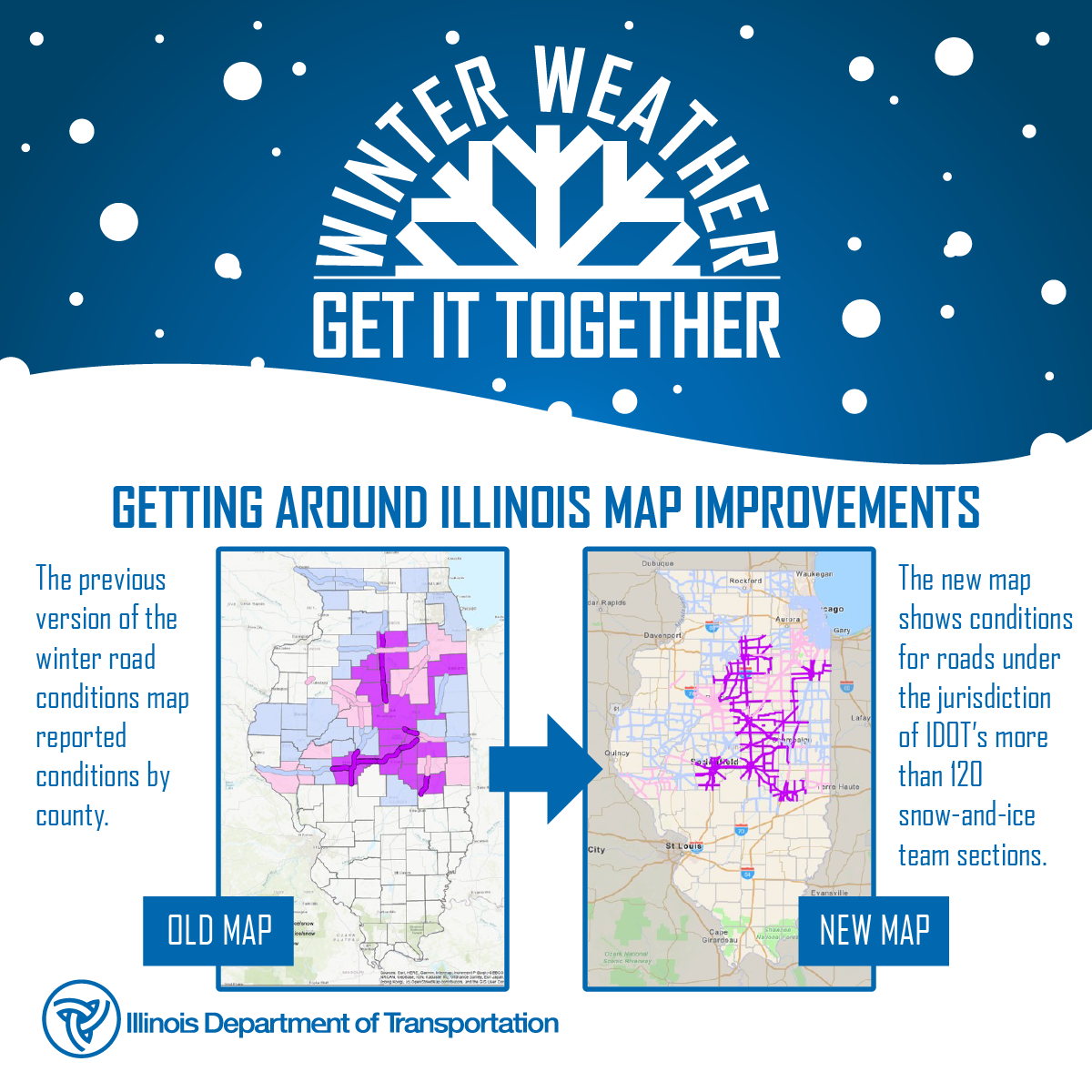

Previously, the map displayed conditions by county. New this year, the map shows how weather events are impacting roads, including the ability to identify and zoom in to a location, travel route or destination with current information recorded by plow drivers.

Individuals can interact with the map to understand how weather events are affecting roads across the state. The winter road conditions map is available on IDOT’s website.

Glowiak Hilton announces new, simple way to apply to all public universities in Illinois

- Category: Press Releases

OAKBROOK TERRACE – First-year students applying to any of Illinois’ public universities will now only need to submit one form on Common App, and State Senator Suzy Glowiak Hilton (D-Western Springs) applauded the step to increase accessibility to higher education opportunities.

OAKBROOK TERRACE – First-year students applying to any of Illinois’ public universities will now only need to submit one form on Common App, and State Senator Suzy Glowiak Hilton (D-Western Springs) applauded the step to increase accessibility to higher education opportunities.

“Applying to college can be tedious and expensive,” Glowiak Hilton said. “By using Common App, Illinois is simplifying the process and working to ensure individuals have access to higher education opportunities.”

This fall, all 12 public universities in Illinois will be available on the Common App platform, thanks to a $1 million state investment.

For families concerned about the cost of submitting college applications, waivers are available for low-income students. In addition, some colleges and universities either have no application fees or will waive fees if needed.

“Many applicants and their families are hesitant to start the college journey because of the associated costs,” Glowiak Hilton said. “Luckily, there are several aid options available to help reduce the financial burdens associated with applying for college.”

Residents are encouraged to visit the Common App website for informational resources, including a first-year application guide, videos and a complete list of institutions that use the application.

Glowiak Hilton moves to recognize October 2021 as Manufacturing Month in Illinois

- Category: Press Releases

SPRINGFIELD – To bring awareness to a strong, statewide industry, State Senator Suzy Glowiak Hilton (D-Western Springs) supported a resolution to designate October 2021 as Manufacturing Month in Illinois.

SPRINGFIELD – To bring awareness to a strong, statewide industry, State Senator Suzy Glowiak Hilton (D-Western Springs) supported a resolution to designate October 2021 as Manufacturing Month in Illinois.

“Manufacturing industry workers play a critical role in Illinois as our state progresses toward a cleaner industrial future,” Glowiak Hilton said. “Declaring October 2021 as Manufacturing Month is an effort to pay respect to their contributions.”

Manufacturing is a competitive sector that works to strengthen the wellness of the economy. The industry employs an estimated 550,000 workers statewide. Since the beginning of the pandemic, Illinois manufacturers have worked to empower Illinois communities by producing production medical supplies to allow families, workers and economies to operate safely.

Senate Resolution 581 was adopted Thursday.

Glowiak Hilton commends small business grant awardees, urges residents to look local for holiday shopping

- Category: Press Releases

“To receive operating assistance from the state, nine locally-owned businesses were able to demonstrate financial loss from the pandemic,” Glowiak Hilton said. “By offering support to small businesses, Illinois is working to strengthen our communities.”

Awarded a combined $550,000, B2B grant recipients in the 24th Senate District include:

- Davanti Enoteca in Western Springs;

- Gia Mia in Elmhurst;

- Subway in Westmont;

- Maize + Mash in Glen Ellyn;

- CluedIn Escape Rooms in Glen Ellyn;

- Budget Inn and Suites in Glen Ellyn;

- Holiday Inn Express in Downers Grove;

- Jumpcut Pictures in Glen Ellyn; and

- Subway in Lombard.

The B2B program allocated $250 million in American Rescue Plan dollars for small businesses hurt financially by the pandemic. Grants ranged from $5,000 to $150,000 and could be used to cover a wide range of operations, such as staff and overhead costs.

“Shopping local can make a difference in our communities this holiday season,” Glowiak Hilton said. “Buying gift cards, recommending a local service or simply interacting on social media can offer support to our small business community.”

A full list of B2B grant awardees can be found on DCEO’s website.

More Articles …

Page 34 of 68