- Category: Press Releases

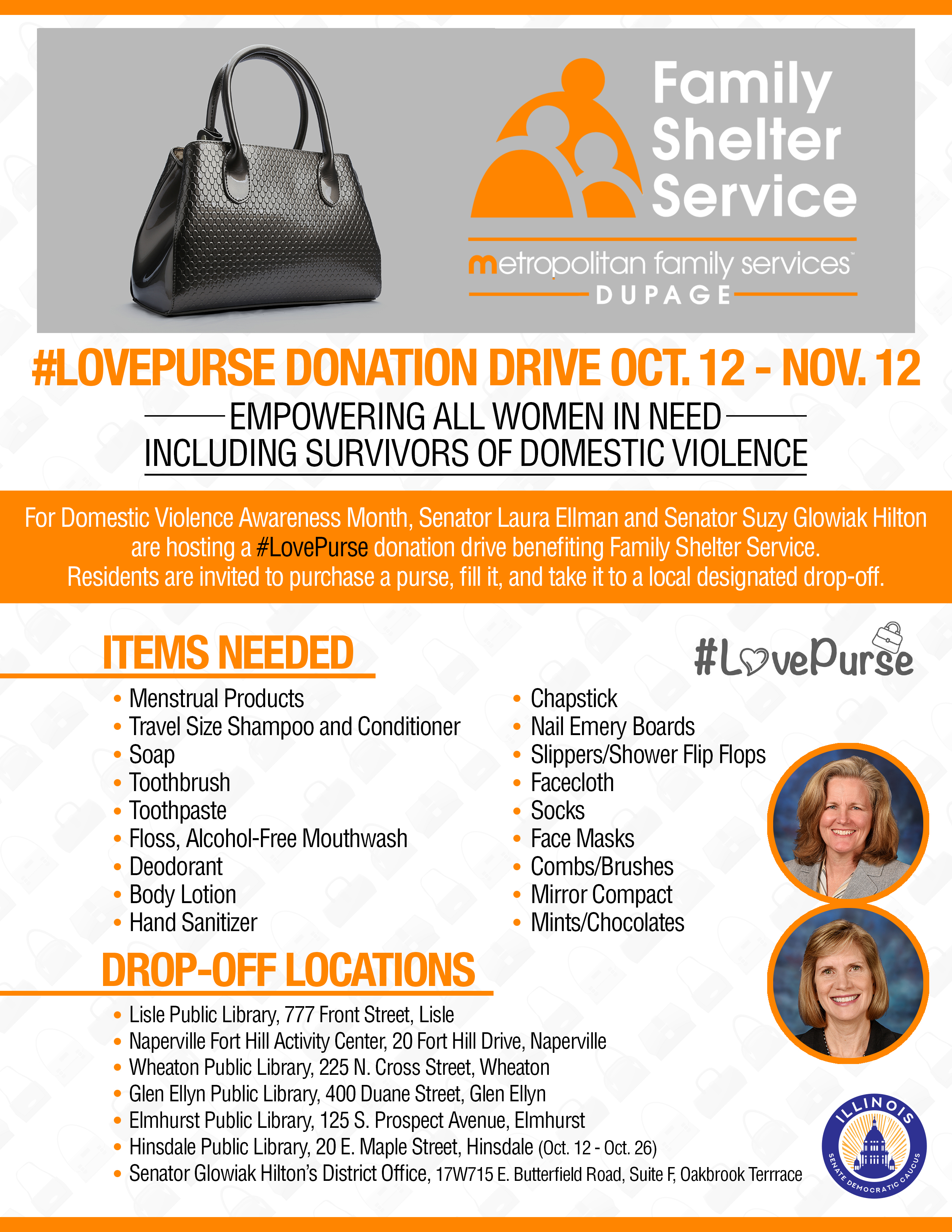

NAPERVILLE – State Senators Laura Ellman (D-Naperville) and Suzy Glowiak Hilton (D-Western Springs) are partnering with Metropolitan Family Services DuPage to hold a #LovePurse donation drive for survivors of domestic violence and other local women in need.

NAPERVILLE – State Senators Laura Ellman (D-Naperville) and Suzy Glowiak Hilton (D-Western Springs) are partnering with Metropolitan Family Services DuPage to hold a #LovePurse donation drive for survivors of domestic violence and other local women in need.

“For many women, a new purse full of care items is a symbol of a fresh start,” Ellman said. “By giving them what they might need, we are telling women who are struggling, ‘You matter, you are cared for, and you are worthy.’”

The #LovePurse initiative collects new purses that are filled with personal care items, toiletries, menstrual products, and notes of encouragement to distribute to women in need and survivors of domestic violence. Residents are invited to purchase a purse and fill it with dental care supplies, shampoo and conditioner, skincare items, and more, and take it to a local designated drop-off. A full list of suggested supplies can be found on the organization’s website.

“When women fall on tough times, there are numerous challenges they may need to overcome,” Glowiak Hilton said. “Offering support to our neighbors by donating purses filled with love can help build a stronger, more cohesive community.”

Purses and other donations can be dropped off at several locations from Oct. 12 to Nov. 12:

- Lisle Public Library, 777 Front Street, Lisle

- Naperville Fort Hill Activity Center, 20 Fort Hill Drive, Naperville

- Wheaton Public Library, 225 N Cross Street, Wheaton

- Glen Ellyn Public Library, 400 Duane Street, Glen Ellyn

- Elmhurst Public Library, 125 S Prospect Avenue, Elmhurst

- Hinsdale Public Library, 20 E Maple Street, Hinsdale

- Senator Glowiak Hilton’s District Office, 17W715 E. Butterfield Road, Suite F, Oakbrook Terrace

More information about #LovePurse can be found on Metropolitan Family Services DuPage's website.

- Category: Press Releases

OAKBROOK TERRACE – To support economic recovery during the pandemic, State Senator Suzy Glowiak Hilton (D-Western Springs) announced $260,000 in Back2Business grants for local businesses and encourages any others eligible to apply before the Oct. 13 deadline.

OAKBROOK TERRACE – To support economic recovery during the pandemic, State Senator Suzy Glowiak Hilton (D-Western Springs) announced $260,000 in Back2Business grants for local businesses and encourages any others eligible to apply before the Oct. 13 deadline.

“As our communities work toward economic recovery, small business owners and employees are among the most impacted,” Glowiak Hilton said. “These grants can support operating costs, and I encourage any struggling business to apply before the deadline.”

Earlier this week, the Department of Commerce and Economic Opportunity announced seven businesses in the 24th District were awarded a combined $260,000 through the B2B grant program. A complete list of grantees is available on DCEO’s website.

“These grants can help offset some costs, but our community must also come together to support our local businesses,” Glowiak Hilton said. “With the holiday season soon approaching, I urge residents to look locally first when shopping.”

The B2B program allocates $250 million in American Rescue Plan Act dollars for small businesses experiencing COVID-19 expenses, and grants will continue to be awarded on a rolling basis with a range of $5,000 to $150,000.

Eligible businesses are encouraged to apply before the Oct. 13 deadline by visiting the DCEO website.

- Category: Press Releases

OAKBROOK TERRACE – The U.S. Department of Education has presented the 2021 National Blue Ribbon School award to 18 schools in Illinois, and State Senator Suzy Glowiak Hilton (D-Western Springs) is congratulating the four awardees in her district on providing an excellent education to the students and families she represents.

OAKBROOK TERRACE – The U.S. Department of Education has presented the 2021 National Blue Ribbon School award to 18 schools in Illinois, and State Senator Suzy Glowiak Hilton (D-Western Springs) is congratulating the four awardees in her district on providing an excellent education to the students and families she represents.

“Especially during this strenuous time, to receive such a prestigious national recognition is a testament to the perseverance of our local students, parents, administrators and faculty,” Glowiak Hilton said. “I applaud all your hard work and wish you well as you press on through the school year.”

Of the 18 schools recognized by the U.S. Department of Education, four are located in the 24th Senate District:

- Butler Junior High School in Oak Brook,

- Hinsdale Central High School in Hinsdale,

- Prospect Elementary School in Clarendon Hills and

- Westmont High School in Westmont.

National Blue Ribbon Schools are selected in recognition of their high performance or significant progress toward closing achievement gaps.

For more information and the complete list of national honorees, residents are encouraged to visit the U.S. Department of Education’s website.

- Category: Press Releases

OAKBROOK TERRACE – Patrons of nine libraries in the 24th Senate District will soon see upgrades to services thanks to more than $316,000 in grants, State Senator Suzy Glowiak Hilton (D-Western Springs) announced Wednesday.

OAKBROOK TERRACE – Patrons of nine libraries in the 24th Senate District will soon see upgrades to services thanks to more than $316,000 in grants, State Senator Suzy Glowiak Hilton (D-Western Springs) announced Wednesday.

“Libraries provide a safe space for residents to use a computer, check out a book or learn a new skill,” Glowiak Hilton said. “People rely on technology for work, school and everyday life—when they can’t access these resources at home, libraries can fill the gaps.”

The $316,086.62 received by nine local libraries is part of $18.1 million in grants awarded to 638 public libraries across the state. For more than 40 years, the Illinois Public Library Per Capita and Equalization Aid Grants Program has helped public libraries with a low library tax base to ensure a minimum level of funding for library services.

Libraries will use the grants from the secretary of state’s office to help fund new services and products, such as audiobooks, adult programming, dual language materials and more.

“State funding helps libraries continue to provide much-needed resources to the community,” Glowiak Hilton said. “Students, seniors and families will reap the benefits of these grants at their local libraries.”

The following libraries in the district Glowiak Hilton represents will receive funds:

- Clarendon Hills Public Library, $12,496.20

- Elmhurst Public Library, $65,078.48

- Glen Ellyn Public Library, $40,488.75

- Helen M. Plum Memorial Public Library District in Lombard, $64,000.25

- Hinsdale Public Library, $24,803.60

- Lisle Library District, $42,043.40

- Oak Brook Public Library, $11,627.43

- Thomas Ford Memorial Library in Western Springs, $19,138.13

- Westmont Public Library, $36,410.38

For more information on the grants, residents can visit the secretary of state’s website.

More Articles …

Page 33 of 65